When you buy a structured debt security, you are lending money to the issuer and become a creditor. The potential return depends on the performance of an underlying security, such as an interest rate or a benchmark equity index.

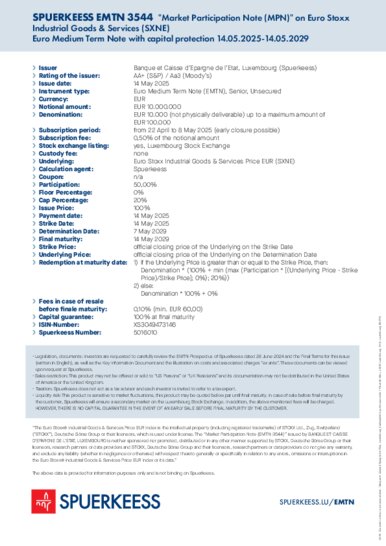

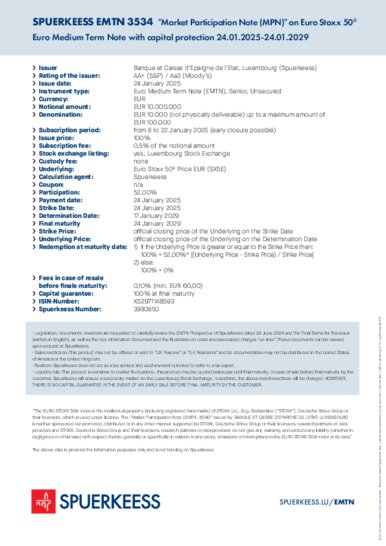

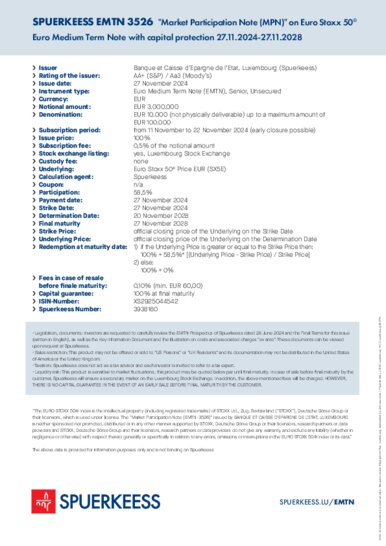

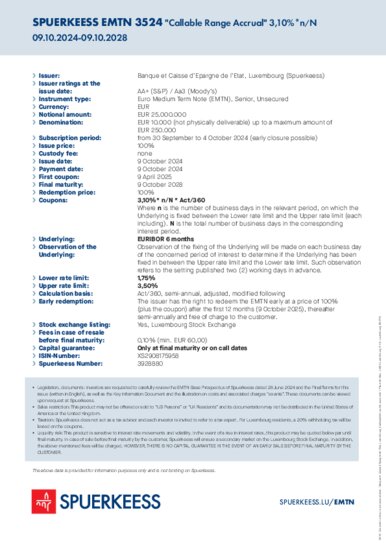

An EMTN (Euro Medium Term Note) is a type of medium-term debt instrument issued in EUR and having a maturity of 1 to 10 years.

SPUERKEESS EMTN 3558

"Callable Range Accrual 2,60%*n/N" with capital protection 18.02.2026-18.02.2030

A “Range Accrual” EMTN is a debt instrument that allows the issuer to pay to the investor a predetermined interest rate at a predetermined date as long as the predetermined index is within a predetermined range.

In other words, on a daily basis check, if the index reference is within the range, the predefined interest rate is paid on the predefined coupon date.

The invested capital is repaid in full at final maturity date (capital protection).