Frequently asked questions

General issues

-

- Report the loss, theft or fraudulent use of your cards to the police station within 24 hours.

- Send your written statement and a copy of the statement to the police authorities as soon as possible to Worldline Financial Services, 33 Rue du Puits Romain, L-8070 Bertrange.

-

If your card is damaged or defective, you can request a new one by calling Worldline Financial Services (Europe) S.A. on (+352) 49 10 10 (option 9). This service is available from 8 a.m. to 6 p.m., Monday to Friday. A replacement fee may apply (please refer to www.spuerkeess.lu/tarifs for more information).

-

Password (PIN) : You must memorise your password and take care not to write it on your bank card or any other media. You should not divulge it to any third party.

If you withdraw money through a bank ATM, following recent attempts at fraud using relatively sophisticated equipment (Skimming), you are advised to check that the equipment is functioning correctly.

- If you use your card on the Internet, take care to enter your card number only on credible or secure Internet sites (https://.....)

- Be wary of phishing

Spuerkeess will never ask you to provide your card security data or your LuxTrust certificate/token data. Do not share it with a third party under any circumstances.

Spuerkeess will never ask you to approve a transaction with your LuxTrust certificate/token.

If you have any doubt, hang up and immediately call Spuerkeess Direct on (+352) 4015-1. -

If your card has been retained by an S-Bank ATM, please contact your Spuerkeess branch or the card issuing bank.

If you notice anything out of the ordinary or any suspicious objects at or near the S-Bank ATM, please contact Spuerkeess direct Direct on (+352) 4015-1 immediately. You can also temporarily block your card via S-Net.

A question specific to the use of 3D Secure and LuxTrust.

-

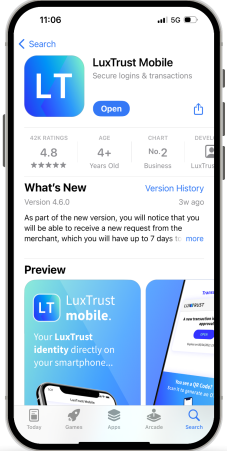

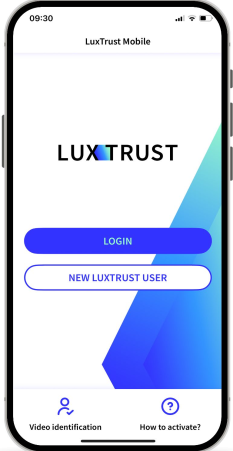

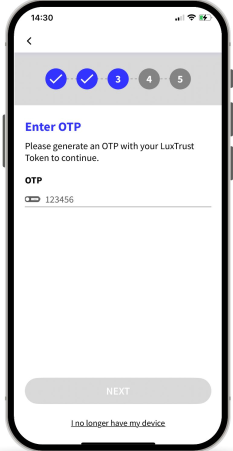

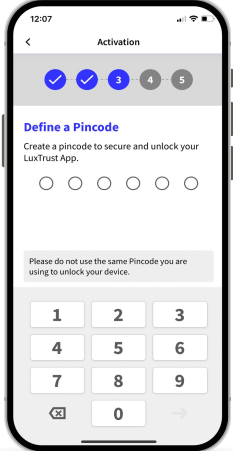

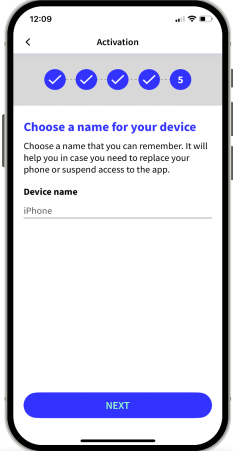

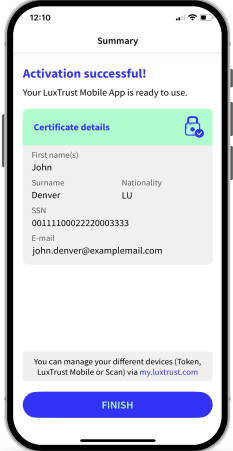

It’s simple, convenient and free of charge! LuxTrust Mobile is the digital counterpart of your physical Token which lets you enjoy greater mobility.

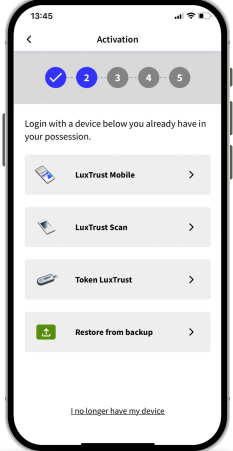

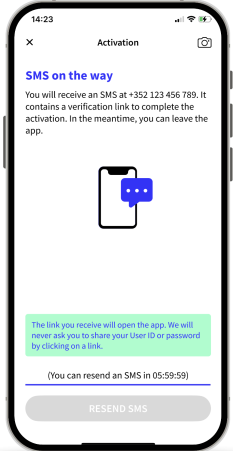

Wait for an SMS from LuxTrust to complete the activation

- LuxTrust will now send you an SMS containing a link to finalise the activation. It can take up to 360 minutes to receive it. In the meantime, you can exit the app.

- When you receive the SMS, click on the link. The LuxTrust Mobile app will open automatically.

- Please, do not share this SMS with anyone. LuxTrust will never ask you to share your credentials by clicking on this link.

-

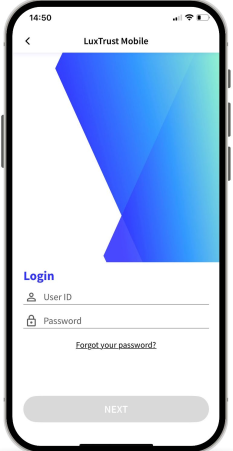

It’s very easy to use LuxTrust Mobile. Verify your identity as usual with your LuxTrust user ID and password on the retailer’s site (or any other site that requires a LuxTrust authentication). Once your data have been verified, LuxTrust sends a notification to your mobile phone so you can complete the authentication process with your digital fingerprint or facial recognition. It will also be possible to scan a Quick Response Code (QR Code) and generate a one-time password (OTP) using your digital fingerprint.

-

Yes, 3D Secure is what we call a “strong authentication”, meaning an authentication that meets strong security criteria, as recommended by the second European directive on payment services for the domestic market (PSD2). This principle became mandatory for all remote electronic payments in 2018 and is applied to all payment card transactions since 2021. It ensures that a fraudster who has been able to steal a security feature (e.g. your card number) will be prevented from making transactions with your cards. For example: if your cards or your card data were to fall into the wrong hands, it would be impossible to make a transaction using the security data from your payment cards without having your LuxTrust security data or your biometric data. If a purchase is made without a strong 3D Secure authentication, you cannot be held liable for fraud, but only the party which requested or authorised such a purchase without 3D Secure.

-

If you have an S-Net agreement, 3D Secure is automatically activated with your LuxTrust certificate used for your S-Net connection (no later than 24 hours after you log on for the first time). Once this activation has been completed, 3D Secure will be activated directly for any new card ordered or when a card needs to be replaced (renewal on expiry or following loss or theft).

If you use several certificates (LuxTrust Token or Mobile) to connect to S-Net, please note that only one certificate can be linked per card. You can check in S-Net which LuxTrust certificate is linked to your card. Log on to S-Net, go to “Settings – Payment Cards – Payment Settings” and, if applicable, change your selection by following the on-screen instructions.

To log on to S-Net Mobile, see the “Settings – Card Management – Payment Settings” section.

-

When you confirm your online purchase with your debit or credit card, you will be redirected to the 3D Secure authentication site where you can check the details of your purchase (merchant, amount, currency). Select your LuxTrust device and authenticate yourself with your LuxTrust security data or approve the transaction via your LuxTrust Mobile app. Once you have authenticated yourself, a confirmation message will be displayed and you will be redirected to the merchant's website or app. The payment will be finalised and your purchase confirmed by your merchant.

-

You do not know the merchant

If you do not know the merchant and you do not believe that you have made such a purchase, please refuse the authentication in LuxTrust Mobile. If you receive a call and you are asked to authenticate a payment or transaction via LuxTrust Mobile, please do not follow such instructions, but hang up and immediately call Spuerkeess Direct on (+352) 4015-1.

You know the merchant

If you know the merchant and you have a business relationship with them (e.g. subscription, online booking), then it is an authentication that is initiated directly by the merchant who is asking you to approve it – to finalise or extend a subscription, for example. This allows you to confirm the transaction, without having to take any further steps. Please only approve such transactions if they seem trustworthy and correct to you.

Contactless cards

-

In Luxembourg, you can make contactless payments for any amount. For payments of less than EUR 50, you don’t need to enter your PIN. For payments of EUR 50 and above, or when you have exceeded a total of EUR 150 since the last time you entered your PIN, you will be asked to enter your PIN in order to approve the purchase. For security purposes and on random intervals, it may occur from time to time that you may still be asked to enter you PIN to approve a purchase. These limits are valid in Luxembourg and vary from country to country.

Miles & More cards

-

Take advantage of the suspension of mileage expiry: as a holder of a Miles & More Luxair Visa credit card, your award miles do not expire provided that you make at least one mileage-generating purchase (which is neither exchanged nor refunded), and provided you have had the credit card for at least three months. More information available at "https://www.miles-and-more.com/row/fr/general-information/terms-and-conditions/no-mileage-expiration-credit-cards.html".

-

Redeem your Miles for a flight ticket from Lufthansa, Luxair and more than 40 other Miles & More partner airlines, or switch to a higher booking class for a previously purchased airline ticket.

To redeem award miles for Prime tickets, please go to the website https://www.miles-and-more.com/row/en/spend/flights/flight-award.html

For further information about the Miles & More program, please contact the Miles & More Service Team: phone (+352) 273 000 96. -

Thanks to your Miles & More Luxair Visa credit card, you benefit from travel accident insurance covering death and invalidity. To benefit from this insurance, all you need to do is to reserve or pay for at least 30% of your trip using your card.

This cover also applies to all the members of the family living under the same roof, whether travelling with you or separately: i.e. your spouse or partner, your children and those of your spouse or partner, provided they are under 25 years old.

-

For data protection reasons, you must contact Miles & More support directly. For more information, please refer to the following website: www.miles-and-more.com/row/fr/general-information/help-and-contact.html

Specific questions about how to use your debit card?

-

If your card is damaged or defective, you can request a new one by calling Worldline Financial Services (Europe) S.A. on (+352) 49 10 10 (option 9). This service is available from 8 a.m. to 6 p.m., Monday to Friday. A replacement fee may apply (please refer to www.spuerkeess.lu/tarifs for more information).

-

The e-commerce feature is disabled by default for Axxess cards. You can enable this feature at any time, either via the card settings in S-Net (enable the "Online payments" option) or by contacting your branch or Spuerkeess Direct at (+352) 4015-1. Please note that you can access this feature until your child turns 15. Once your child reaches that age, he alone will control his Axxess card in S-Net (unless the legal(s) representative(s) for the minor’s account object(s)).

-

You can cap the purchasing limit on your children’s Axxess card at any time, either via the card settings in S-Net or by contacting your branch or Spuerkeess Direct at (+352) 4015-1. Please note that you can access this feature until your child turns 15. Once he reaches that age, your child will be able to manage his cards in S-Net on his own (unless the legal representative(s) for the minor’s account object(s)).

Use of your credit card

-

- The monthly closing for all Spuerkeess credit cards takes place, in principle, on the penultimate working day of the month.

- You may consult the closing date and the date of balancing of your credit card at any time via S-Net and S-Net Mobile.

The statement and debit dates of the year 2024:

MonthStatement dateDebit dateJanuary30/01/2407/02/24February28/02/2407/03/24March28/03/2409/04/24April29/04/2407/05/24May30/05/2407/06/24June27/06/2405/07/24July30/07/2407/08/24August29/08/2406/09/24September28/09/2407/10/24October30/10/2407/11/24November28/11/2406/12/24December30/12/2407/01/25The statement and debit dates of the year 2025:

MonthStatement dateDate Account DebitedJanuary30/01/2507/02/25February27/02/2507/03/25March29/03/2507/04/25April29/04/2507/05/25May28/05/2505/06/25June28/06/2507/07/25July30/07/2507/08/25August28/08/2505/09/25September29/09/2507/10/25October30/10/2507/11/25November27/11/2505/12/25December30/12/2507/01/26

Questions concerning packages

-

For any additional cards you wish to add to your Zebra package, the standard rate will apply.

For any Visa Classic or Visa Premier credit card you wish to add to your Zebra Premium package, the rate is half the standard annual fee. For any debit card you wish to add to your Zebra Premium package, the standard rate will apply.