Information on myTax

General information

-

Depending on their household situation, some taxpayers are required to file a tax return.

Most other taxpayers have an interest in filing a tax return (or an annual statement) in order to recover excess tax deducted at source from their income(s). This surplus often represents a significant amount for households, which can amount to thousands of euros.

-

The myTax assistant is meant for all taxpayers. Whether you are an expert in taxation or, on the contrary, you have no knowledge of the field, myTax guarantees you will always pay the right tax amount.

- Are you accustomed to fill in your tax return on your own? Now you can access an assistant to ensure you don't miss out on any benefits and/or learn more about taxation.

- Have you never filed a tax return before? The myTax assistant makes taxation accessible and ensures that you do not overlook a tax obligation or miss out on a potential tax refund of any excess tax deducted at source from your income.

- Do you rely on a friend or acquaintance to help you? Take advantage of a digital assistant to help you both or allow you to independently understand and handle your taxation.

-

Whether you are a Luxembourg resident or not, the myTax assistant developed by Edonys makes taxation truly accessible to everyone, regardless of the complexity of their situation.

No supplement will be charged should you need appendices to your return and you will be clearly informed of the amount of tax to be recovered from or paid to the Luxembourg tax authority.

Here are the advantages most often reported by users:

- The myTax assistant is remarkably user-friendly

- Saving time and money thanks to an automatic pre-filling and the intelligence of the myTax algorithms

- The most complex situations are handled and optimised (rental income, property sale, foreign income, investments, …)

- Explanations guide the user throughout the entire questionnaire;

- All tax benefits f for which a household may be eligible are considered;

- Automatic updates conducted by Edonys and based on the most recent legal and regulatory changes free you from the yearly hassle of informing yourself

-

The myTax assistant is made up of thousands of algorithms supervised and continuously improved by passionate experts.

Furthermore, it is recognised and used by many companies (available to employees as a benefit) and tax professionals who file thousands of returns every year.The myTax assistant is updated annually based on the latest legal changes. An evaluation committee set up by VIREO ensures:

-

If you submitted a tax return to the Luxembourg tax authority while not being required to file one you will not have to file it again the following year.

This is why, every year, your myTax tax return tells you whether or not you are required to file a tax return (or an annual statement).

In practice, if a tax return has been filed in a previous year, the Luxembourg tax authority will probably send you a letter the following year requesting a tax return because your file will be saved in its database.

However, you may tell the Luxembourg tax authority that you no longer wish to file a tax return. It will then be removed from its database.

Using the myTax assistant

-

Yes. You can exit and return into the myTax questionnaire as many times as you like, thanks to the chapters displayed at the left menu of your questionnaire screen.

If you do not have time to do everything at once or do not have all the documents at your disposal yet, you can fill out your questionnaire in several sessions.

-

To go back and modify information that is already encoded, use the chapters displayed on the left side menu of your screen.

Use the tooltips (?) if you have any doubts about an answer to a question.

If you wish to exit the questionnaire and resume it later, please be aware that your data will be automatically saved. You will be able to access it again via your Tax Area.

To ensure optimal navigation, we recommend the use of one of the following (updated) browsers: Google Chrome - Mozilla Firefox - Safari - Edge Chromium.

How the myTax assistant works

-

The myTax assistant is made up of thousands of algorithms and simple questions.

All you have to do is answer these questions in order to generate a tax report allowing you to:

- find out if filing a tax return (or an annual statement) is mandatory or advantageous in your situation

- choose your tax method and view the amount of tax to be recovered from or paid to the Luxembourg tax authority

- download your completed tax declaration and the optimised, completed and ready to send appendices potentially existing;

- discover the opportunities provided by the Luxembourg State to reduce your household's annual tax burden.

-

Yes, VIREO keeps the myTax assistant up to date based on the latest legal and regulatory changes.

It is therefore no longer necessary to stay up-to-date with the latest information or to know all the tricks to optimise your tax return. MyTax takes care of this for you and allows you to save valuable time.

myTax tax return

-

Once your documents have been sent to the Luxembourg tax authority, the latter will "revise" your tax return and send you a report.

This report is referred to as "Tax Assessment Notice" or "Tax Statement". It includes all the information related to your taxation as well as the final amount that you can recover or that you must pay.

Pricing and payment for the service

-

The myTax service is only billed once per tax year (at the standard rate of €40 at launch in March 2022).

You are free to start filling in the myTax questionnaire at no charge. Only after this has been finalised and before accessing the results of the tax report and its various forms does this billing take place. You can then return to the questionnaire to generate new versions of the tax report and its various forms without additional billing.

Please note: the optional use of the tax safe is completely free of charge.

Forms, appendices and certificates

-

In order to comply with the forms provided by the State of Luxembourg, some data generated by myTax may be merged. This is particularly the case if you have a large number of special expense items.

For example, if you have 10 civil liability insurance items, myTax will group them together in a single line.

If you are in a couple and have opted for joint taxation, some calculations may have been allocated between the two of you.

For example, if you have EUR 1.000 in special expenses, myTax will indicate EUR 500 in expenses for each of you.

Sending your documents

Pre-filling of the myTax questionnaire

-

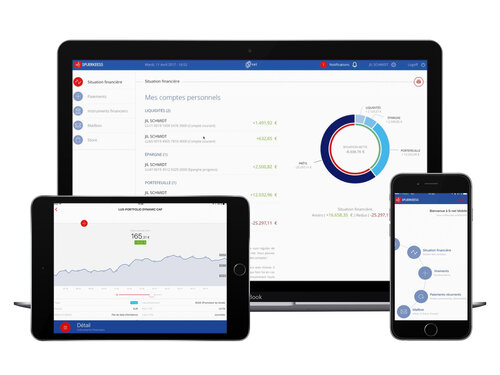

Should your transactions - executed via S-Net - be useful for your tax declaration, they will automatically be stored in your tax safe deposit box.

Simultaneously, some information shared between S-Net and myTax allow the algorithm to automatically pre-fill some answers of the questionnaire with the clear objective to save you time.

-

The first year of using myTax, you must answer all the questions according to your situation.

From the second year of use, you can use the data from your previous myTax questionnaire. All you will have to do is update the information from the previous tax year.

The biggest part of your answers will already be pre-filled to allow you to save valuable time.

Types of expenses

-

Throughout the questionnaire, you will be asked to report any household expenses, some of which may be deductible.

Therefore, you should not only consider the "Special Expenses" and "Extraordinary Expenses" sections.

For example, the tax benefits related to children such as "allowance for children who are not part of the household" can be found in the "Children" section and not the "Extraordinary Expenses” one.

Examples of tax benefits

-

Here are the most common advantages attributed by myTax. They represent only a small part of all the automatic optimisations performed by its algorithms:

- Children: tax relief, tax bonus, single-parent credit, allowance for a child not forming part of the household, …

- Adaptation of the interest subsidy / interest relief and/or preferential rate granted by an employer for personal loans or loans linked to the main residence

- Revaluation of the deductibility limit for housing savings

- Categorisation of extraordinary expenses (childcare, funerals, cures, legal fees, ...) as actual expenses or allocation of flat-rate allowances

- Treatment of salaries received in the context of teleworking

- Treatment of salaries received during the Covid-19 crisis and/or following post-Covid-19 provisions

- Exemption of income not taxable in Luxembourg and treatment of foreign income taxable in Luxembourg

- Detection of the advantage or not to be requested to assimilate to residents (for non-residents)

- Financing costs related to the purchase/renovation of a property

- Categorisation of depreciation, capital expenditure, repair and/or maintenance costs

- Prorating for taxpayers who become residents or move during the year

- Detection of deductible expenses incurred abroad

- Rectification of tax class in case of errors in remuneration certificates

- Deduction of actual expenses related to the professional activity

- Increasing the deductibility limit via residual debt insurance paid in a single premium

Data protection

-

As part of our partnership with VIREO, Spuerkeess has chosen to implement myTax within its own IT infrastructure. This way, you can be sure that all the data collected are not transmitted via a third-party infrastructure, which guarantees their security and confidentiality (as is the case for all your data available on S-Net).

-

Yes, you have a maximum of 18 months to complete your myTax questionnaire. After this period, the data already entered will be deleted and, if necessary, you will have to start the questionnaire again for the year in question.

However, we would like to remind you below of the deadlines imposed by the Luxembourg tax authority (“Administration des Contributions Directes”) for submitting your return:

In general, it invites you to prepare your annual tax return before 31 March. That said, this date is merely a recommendation, the actual deadline being 31 December of year “n+1” (for income in year “n”).

After this date, the Luxembourg tax authority will no longer take any tax deductions into account, whether from special expenses, extraordinary expenses, etc.

Specifically, for married resident or non-resident taxpayers who wish to change their tax method (for example, to switch from joint to individual taxation or vice versa): the deadline is 31 March.

-

No. In accordance with the legislation on the protection of personal data, Spuerkeess explicitly requests your consent to use your data for purposes other than the tax return when you are asked to confirm the myTax general terms and conditions. This consent is therefore not mandatory to use the myTax assistant and is not activated by default. If necessary, you will always have the choice of revoking this consent directly in S-Net’s settings, under the “Data processing” section.

-

The aforementioned data will be kept for a maximum of ten (10) years after the session has been completed, i.e. after reaching the final stage of the tax report for a given tax year, in order to enable you to justify to the Luxembourg tax authority the calculations used to determine your tax returns.

This remains valid even if you were to terminate your business relationship with Spuerkeess during this period.

How the service works

-

Under the <<Know Your Customer>> legislation, S-Net asks you on an annual basis to check and update, if necessary, some of your personal identifying data.

If these change in the meantime, please go back to the main S-Net menu and access your user profile section “My personal data” to update them.

Please note: for data that cannot be modified in S-Net, you can contact your Spuerkeess advisor to update them.

After that, we invite you to restart your myTax questionnaire to see if your changes have been taken into account.

-

S-Net uses your identifying and product data, as well as the data detected and injected into your tax safe to pre-fill the myTax questionnaire. However, not all of this data will be included at the launch of the service and Spuerkeess will progressively enhance the pre-fill during the ongoing updates of S-Net.

In any case, Spuerkeess cannot guarantee the completeness of this pre-filling.

It is therefore essential that you check and validate all the pre-filled data throughout the questionnaire and adapt or delete them if necessary.

We also encourage you to validate the content of the various forms generated before signing them and sending them to the Luxembourg tax authority..

Please refer to the myTax Terms of Use for more information.

-

The purpose of the tax safe deposit box is to gather all of the documents and/or supporting documents you will need to file with your tax return in one place.

To make this easier for you, an automated transaction categorisation algorithm has been set up based on the Spuerkeess transaction history linked to your current account(s).

Third-party accounts held with your other banks are not currently taken into account.

You are free to add to or modify the contents of your safe deposit box at any time through the safe deposit box or your transaction history if you notice any categorisation errors or omissions.Additionally, you can upload any document and/or supporting document from other banks or entities directly in their tax category.

Please note that the tax certificates generated by Spuerkeess at the beginning of the year, which are usually available in your e-documents in S-Net, will also automatically be transferred to your tax safe deposit box. -

The 2021 tax file is what you need to file your tax return in 2022, i.e. for your income and expenditures from 2021.

As such, you will find the transactions along with any corresponding debit/credit advices booked in 2021.

Certificates issued by Spuerkeess in early 2022 can therefore be found in the file for the 2021 fiscal year.

When uploading a document, it is advisable to access the fiscal folder of the year linked to the document/certificate. Please note that the year may be modified directly within the upload form.