Markets waiting for sunnier days

Investment Update - April 2025

Relying on fundamentals despite everything

A very complicated month of March has ended on the financial markets, which suffered from fears of a trade war threatened by US President Donald Trump.

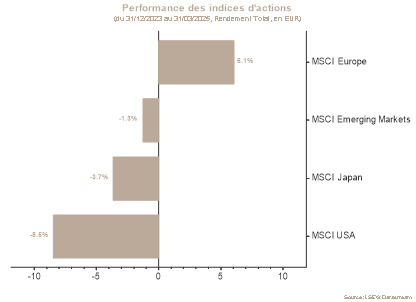

While there were already signs of hesitation in February, March proved decisive in the loss of risk appetite. The performance in euros of -7,5% on the equity indices speaks for itself.

Investors lost confidence and visibility in the period that loomed before the spectre of “Liberation Day” on 2 April, when Trump promised to apply “reciprocal tariffs.”

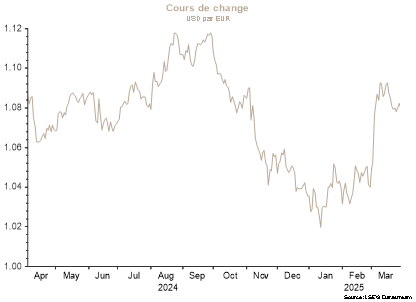

At the same time, the US 10-year rate ended the month at 4,20%. In Europe, movements on the German 10-year rate were rather sharp: after rising in the first half of the month due to the announcement of investment plans, financed by new debt issues, they then fell following economic fears related to customs duties. Thus, the 10-year yield rose from 2,40% to more than 2,80% in a few days before returning to a downward trajectory.

In the meantime, published economic figures should be taken with a pinch of salt: strong employment, inflation and economic activity figures reflect only past economic conditions. However, the environment in recent weeks has been one of deteriorating confidence, whether for households or businesses, in contrast to economic data that has not yet adapted to the new conditions.

In short, this loss of visibility and confidence made a clean sweep of the economic forecasts that were in force at the beginning of the year. Take the example of the United States, where growth was expected to exceed 2% at the beginning of the year. The gradual erosion of these forecasts in the current environment is now giving way to stagflation (economic stagnation combined with inflation) and even recession scenarios. Similarly, lingering doubts may override the slight recovery expected in Europe (nearly 1% growth was anticipated at the beginning of the year), since part of this growth is likely to disappear, particularly due to risks surrounding exports to the United States.

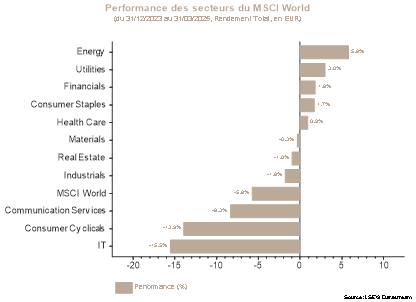

In conclusion, as the abovementioned economic risks are not fully discounted by the stock market indices, the equity allocation has moved from overweight to underweight, with a reduction in sensitivity to the economy. The Consumer Discretionary and Financial sectors were also downgraded. With European rates rising and recession risks increasing, duration was extended via German bonds. Finally, the recommendation on High Yield moved to underweight, particularly via the US bucket.

Stock markets

The month of March was marked by high volatility on the equity markets, mainly fuelled by the continuing uncertainties triggered by the global trade war and the US tariff policy.

The S&P 500, dragged down by trade tensions, fell significantly over the month and even hit six-month lows.

In Europe, the change in the German fiscal framework with the approval of a stimulus plan for infrastructure and defence was not enough to offset the uncertainties weighing on the markets.

In addition, several quarterly results from key companies such as Marvell, Fedex and Nike disappointed, adding to concerns about economic growth.

Caution is still warranted in the Basic Materials and Energy sectors, which are affected by uncertainties around global demand. The European Real Estate sector remains attractive, as does the Communications Services sector, both in terms of the telecommunications segment and the technology segment that is more sensitive to developments in AI. It is clear that a lack of consumer confidence and economic uncertainties are putting the performance of real data at risk. The allocation to the Consumer Discretionary and US banks sectors was also neutralised.

Sovereign yields and the credit market

In March, the trajectories of US and European sovereign rates were very different. In the US, the 10-year yield remained relatively stable, hovering around 4,20%. By contrast, in Europe, yields rose sharply: the German 10-year rate rose from 2,40% to 2,73% at the end of the month, even temporarily exceeding 2,90%.

This movement is largely explained by a major fiscal turnaround in Germany. The future governing coalition has proposed a reform of the “debt brake” enshrined in the Constitution, in order to increase defence spending and create a €500 billion infrastructure fund. The effect of this announcement on rates was immediate, triggering the biggest daily rise in the 10-year Bund yield since German reunification in 1990: +0,30% on 5 March alone.

In the US, trade tensions weighed on the market. The tariffs already announced, as well as those expected in early April, have fuelled economic uncertainty. Concerned investors revised their growth expectations downwards, as fears of persistent or even re-accelerating inflation were revived.

Finally, in the credit market, concerns about growth trends weighed on high yield bonds. Companies issuing these securities, which are often more cyclical and highly indebted, are more sensitive to an economic slowdown and tighter financial conditions, which explains their underperformance over the month.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.