More practically, the questionnaire contains the following components:

1. Your financial situation – an assessment of your income, capital and how you manage your finances.

2. Your requirements – the yield you are hoping to achieve, your appetite for risk, attitude towards losses, etc. will be determined.

3. Your plans – your investment horizon, and whether it is more short-term or long-term.

4. Your knowledge – the experience you demonstrate regarding existing financial products and your knowledge will be assessed.

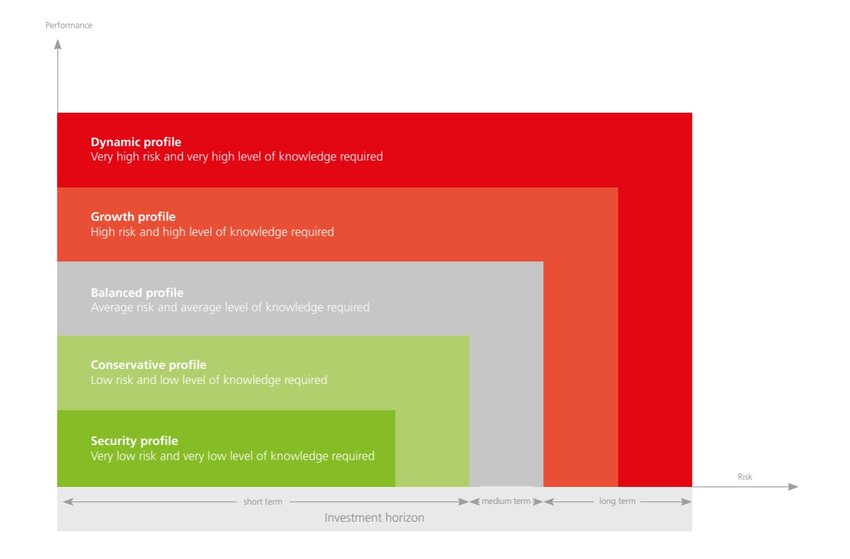

Once the questionnaire has been filled in, a “score” is awarded on the basis of the investment period, risk appetite, etc. This score will ultimately determine your investor profile.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/f/csm_272__FIN__Que_faire_apres_l_unif__01_0f17e00166.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/d/2/csm_AideFi_Diplome_88d34755dd.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/a/csm_255__To_do_list_06466e90eb.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/e/e/csm_255__Bourse_872882e1eb.jpg)

![[Translate to English:] Budget, well-being, Relaxed couple contemplating their finances](/fileadmin/_processed_/1/9/csm_311__FIN__Mon_budget_mon_bien-etre__1__d02469e82e.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/e/5/csm_parlons-argent-aux-enfants-289_95d8bb506a.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/a/csm_290__Debit-_und_Kreditkarten__Mise_a_jour_N__85___1__19505e816a.jpg)