-

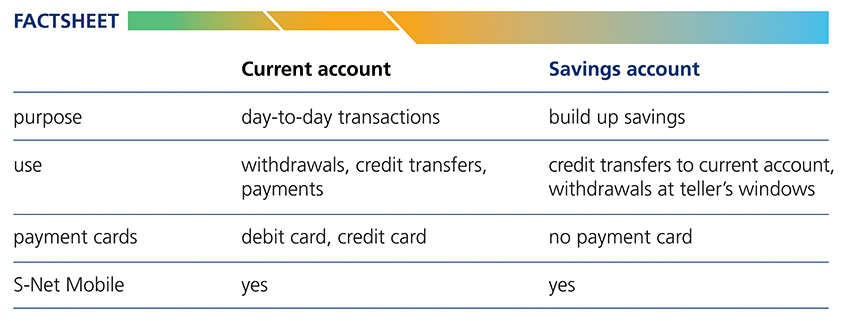

Savings accounts and current accounts are set up for different reasons.

Savings account

As its name suggests, a savings account is a bank account where money is deposited to build up savings. You can make cash deposits or transfer money from another account to it. To recover your savings, all you have to do is transfer the amount you want to your current account or withdraw money from the teller’s window at the bank.

There are two types of savings accounts available for minors: a blocked savings account that is locked until the minor turns 18 and an Axxess savings account, which can be accessed from age 15.

Current account

A current account is used to manage everyday expenses. You can deposit your student wages or allowance to this account, and use this money to pay daily expenses via credit transfer or with your payment card. In fact, a payment card (debit and/or credit card) is typically linked to this type of account. That way, you can access your money whenever you want by withdrawing cash from ATMs or making purchases at stores or online.

-

In theory, you should not be able to overdraw your account with Axxess. Your Axxess card will only work if the account balance is greater than or equal to the transaction amount in question.

The only time your account may have an overdraft is on the day your credit card transactions are processed. Check your balance regularly to ensure you have sufficient funds to cover your total credit card transactions.

-

Réaliser vos paiements grâce aux différentes cartes de paiement

Payment cards allow you to pay for goods and services without using cash.

Types of payment cards include:

- DEBIT CARDS (the vast majority of existing cards). When you pay with a debit card, the amount paid is deducted from your current account at the time of payment – it’s an IMMEDIATE DEBIT.

- CREDIT CARDS; when you pay with a credit card, the amount is deducted every month from your current account – it’s a DEFERRED DEBIT.

Debit cards – payment cards with immediate debit

The "Visa Debit" and "Axxess" debit card:

Visa Debit is a debit card, i.e. every payment made and every cash withdrawal is deducted immediately, or within a couple of days at the most, from the linked current account. The available balance in the current account is therefore continuously updated, allowing the customer to manage their expenses optimally.

The "Axxess" debit card is intended for young people aged between 12 and 30 years. It is provided free of charge as part of the Axxess Start, Study and Job banking packages. In addition to all the features of a "normal" debit card, it offers extra-banking benefits, such as discounts with Spuerkeess partners.

Features of a debit card:

Easy and useful!

- Retraits d’argent au Luxembourg et à travers le monde

- Sur les distributeurs S-Bank de Spuerkeess, c’est toujours gratuit !

- Paiement dans les commerces, affichant le logo VISA, au Luxembourg et à travers le monde

- Fonctionnalité « contactless »

- Vous pouvez utiliser votre carte sans saisir votre PIN en dessous de EUR 50 * et jusqu’à un plafond cumulé de EUR 150

- Débit immédiat

- Après chaque paiement, votre compte est débité, ce qui vous permet d’avoir un bon suivi de vos dépenses

- Consultation des soldes via S-Net, S-Net Mobile et via les distributeurs S-BANK de Spuerkeess

- Possibilité d’achat ONLINE

- Les cartes de débit sont polyvalentes, elles permettent également le paiement en ligne, les 16 chiffres de la nouvelle carte, sa date d’expiration et les 3 chiffres CVV2, sont les données nécessaires à l’exécution d’un paiement sur Internet. Les jeunes peuvent utiliser leur carte Axxess pour les achats en ligne à partir de 15 ans.

Credit cards – payment cards with deferred debit

The credit cards offered by Spuerkeess (Visa Classic, Visa Premier, Miles & More Luxair Visa) offer the same functions as the Visa Debit debit card (in-store and online purchasing and cash withdrawal).

So what’s the difference?

Amounts spent with a credit card are deducted from the linked current account in one go, generally at the beginning of the following month. The maximum amount that the customer can spend depends on their personal situation.

There’s a huge range of possibilities!

There are many different sorts of credit card, notably Visa, Mastercard, Diners Club or American Express. The first two in this list are the most widely accepted, and Spuerkeess offers Visa cards exclusively.

- Cash withdrawals in Luxembourg and worldwide:

- It’s always free at Spuerkeess’s S-Bank ATMs!

- Cash withdrawals are debited immediately!

- Payment in shops displaying the VISA logo, in Luxembourg and worldwide.

- Contactless functionality:

- You can use your card without entering your PIN for amounts below EUR 50* and up to a total of EUR 150.

- Online shopping: make purchases online, book flights and hotels...it couldn’t be simpler when you use your credit card.

- Easy travel: a preferred means of paying a deposit e.g. for a rental car.

- Insurance: every credit card comes with an insurance package (e.g. protection for stolen or damaged goods on Visa Classic, Visa Premier and Miles & More Luxair Visa).

- Credit limit management: your credit card gives you a spending limit, e.g. EUR 500 per month. If you have S-Net or S-Net Mobile, you can easily increase the limit on your credit card.

* For security purposes, you will sometimes be asked to enter your code even for contactless payments below EUR 50.

- Repayment options: you have two options for repayment

- 1. Full repayment: the total amount of your monthly spend is deducted in one debit from your current account.

- 2. Staggered repayment option: did you have a major expense? You can opt to repay in instalments over several months, so you benefit from a flexible credit facility. Note, however, that you will be charged interest under the current conditions.

- Deferred debit: unlike a debit card, your account is not debited immediately, but at the end of the month. If, for example, you opted for "Full repayment", and you spent EUR 250 on your credit card over the month, that amount will be deducted from your current account at the beginning of the following month. This means, of course, that you must have enough funds available in your current account when the deduction is made, otherwise your account will be in the red.

Tip: when paying abroad (outside the eurozone), you often have the option of selecting euro or local currency. We recommend that you select the local currency, which normally has a better exchange rate.

Nouveau !

Payment cards (debit and credit cards) can now be issued instantly. If you have an S-Net or S-Net Mobile agreement, your payment card can be used as soon as it is ordered, so you don’t have to wait.

As soon as you have ordered your card, you can make online purchases and add your new card to your Apple Pay wallet.

How can I find card information in S-Net or S-Net Mobile?

- Select a payment card from your financial situation page.

- Click on the "three dots".

- Click on "Information" then "Show details": find your card details – the 16-digit number, the expiry date, and the 3-digit CVV number.

In addition:

Any customer can manage their bank cards in their S-Net/S-Net Mobile, i.e.:

- Authorise/block online payments, payments outside Europe, cash withdrawals and payments using the magnetic strip;

- Request a new PIN code;

- Change the monthly spend limit on the card;

- For credit cards, view the remaining balance, close date and payment deduction date.

-

A special feature of the Axxess card is that it does not allow you to overdraw your account. If you do not have sufficient funds, the attempted transaction will be declined.

What’s great about the Axxess debit card is the exclusive non-banking advantages you get from Axxess partners just for showing your card.

-

2. File a complaint with the police.

- Report the loss, theft or fraudulent use of your cards to the police station within 24 hours.

- Send your written statement and a copy of the statement to the police authorities as soon as possible to Worldline Financial Services, 33 Rue du Puits Romain, L-8070 Bertrange.

-

Have you forgotten your PIN code?

You can retrieve it directly from S-Net Mobile & Desktop by clicking in your Financial situation on the “Information” button from your card. If your card is blocked following multiple wrong entries of your PIN code, it will be automatically unblocked after consulting your PIN in S-Net.

Or

You can request a reissue by contacting Spuerkeess Direct on (+352) 4015-1. You will receive your new PIN at your home address in a sealed envelope. You can then easily change your PIN at any Spuerkeess S-Bank ATM.

-

The PIN code is a lightweight authentication method that allows you to perform certain tasks without having to connect via your LuxTrust Token. The following operations are authorised via PIN authentication:

-

LuxTrust Mobile is an app used to establish an electronic identity on the Internet and to securely exchange your personal data with third parties. For example, you can use it to log in to your online banking or complete administrative formalities on myguichet.lu. The advantage of this app is that you don’t need to have your Token on you to do things online.

Here’s how to log in to LuxTrust Mobile: