The economy and markets are smiling in the Trump 2.0 era

Investment Update - December 2024

The economy and markets are smiling in the Trump 2.0 era

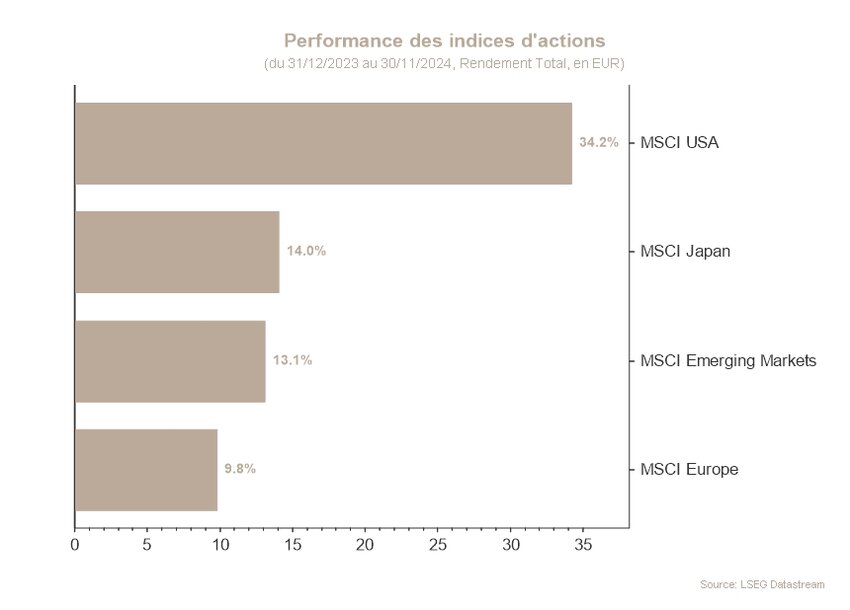

The financial markets clearly welcomed the announcement of Donald Trump’s incoming presidency. Performances speak for themselves: global equities reached +6,66%*. Taking a closer look, it should also be noted that US equities benefited the most, gaining +9,22%* in euros. For its part, Europe ended the month on a hesitant rise, posting a dismal +1,08%*, as the Old Continent finds itself subject to Mr Trump's threats regarding customs tariffs. However, it was nothing compared to emerging markets, which lost -0,90%*, or China, which finished in the red at -1,74%* at the end of the month.

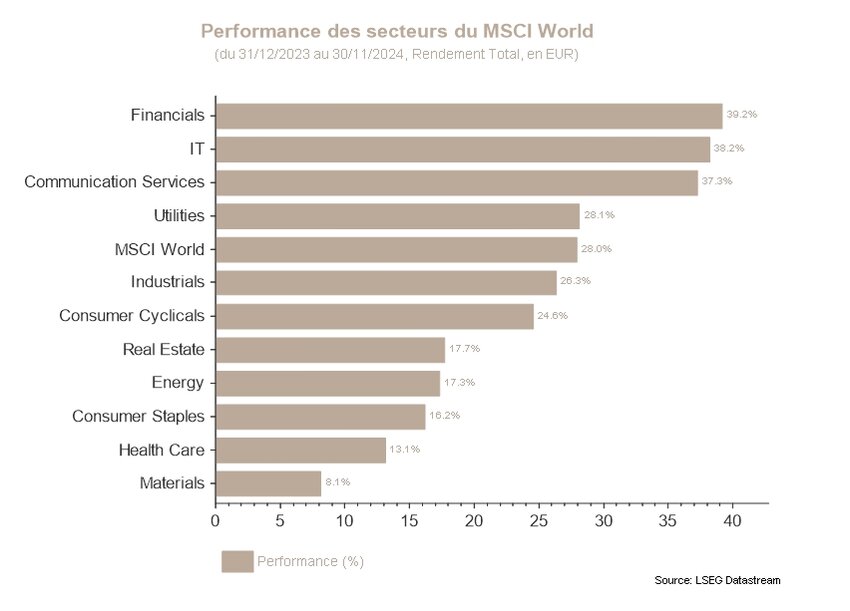

A closer look at the sectors shows that the US bank sector is leading the way with +17,30%*, supported by expectations of the deregulation that the US president-elect has vocally promised. Elsewhere, the Consumer Discretionary segment was also strong, driven by the significant outperformance of Tesla, which surged by 42%* at the end of the month.

In terms of currencies, the greenback continues to appreciate against the single currency, at 1,0577 per euro.

On the bond front, November was less upbeat than October. US bond yields fell by a few basis points (-11bp for the 10-year), in particular since the appointment of Scott Bessent as Treasury Secretary. Indeed, the hedge fund manager at Soros is seen as a counterweight to Donald Trump both on the issue of tariffs and on tax evasion. For the eurozone, Germany in particular, bond yields fell significantly (-30bp on the 10-year). Fears of a bitter trade war with Europe could have a major impact on its already troubled economy, such as a shock wave that could push the ECB towards an even more dovish monetary policy in the coming months.

While gold soared for several months in a row, this upward trajectory came to a halt, falling 5,3% over the month. In addition, with Donald Trump’s arrival at the White House, the markets saw the possibility of an imminent end to the main armed conflicts in Ukraine and the Middle East.

The US economic data reflects a robustness that appears unwavering. GDP for the third quarter was confirmed at 2,8%, leading to excessively persistent inflation that is struggling to move towards the target set by the US Federal Reserve (Fed). It remains at 2,6%, and if we exclude the most volatile elements such as energy and food, 3,3%.

For its part, Europe is in much less Olympic form. GDP for the third quarter was set at 0,9% and in terms of inflation, the downward trend is confirmed, with headline inflation at 2% and core inflation at 2,7%.

*Performances are calculated in euros.

Stock markets

In November, markets were dominated by the impact of the US elections. The victory of Donald Trump and the Republican majority in Congress increased expectations of expansionary policies, linked in particular to tax cuts, and increased support for industry. This outlook has propelled US small caps and the financial, industrial and energy sectors have particularly benefited from this environment.

In Europe, performance was more mixed. Profit warnings in the Automotive and Consumer Goods sectors and concerns over US trade policy affected the interests of the eurozone markets. On the other hand, UK stocks, buoyed by the solidity of financials, held up better.

The current positioning favours sectors such as Technology, Communications Services, which should offer resilient yields, US banks, which should benefit from the election of Donald Trump, and Healthcare, which is attractively valued. Conversely, we maintained a reduced exposure to Materials, Energy stocks and Chinese equities, the latter remaining vulnerable to trade tensions and macroeconomic uncertainties, particularly in relation to the Chinese political landscape.

During the month, profit-taking on US small caps led to a repositioning on mid caps, where fundamentals and valuations are attractive. European pharmaceutical stocks also remain a strong conviction, supported by promising innovations and a strong dollar. This allocation aims to combine quality, growth potential and risk management in a complex environment.

Sovereign rates and credit market

In November, sovereign yields followed a slightly downward trajectory in the United States, while in Europe, the movement was much more pronounced: the US 10-year yield fell by 11bp and the 2-year by 2bp, while in Germany, the 10-year lost 30bp and the 2-year lost 33bp. Thus, since the beginning of September, the yield curves have returned to normal, at least beyond the very short term, with the 10-year rate now higher than the 2-year rate.

In the United States, the bond market only had eyes for the elections on 5 November. As investors prepared for a second term under Donald Trump, inflation and growth expectations soared ahead of the election and in the days following it. As a result, investors gradually reduced their ambitions regarding the extent of movements on key rates, while bond yields increased. However, in the second half of the month, the prospect of less hard-line policies and more centrist appointments drove rates lower. On the other hand, the Fed’s message remains cautious, with its Chairman arguing that the economy is “not sending signals that we need to hurry to lower rates”.

In Europe, sovereign bond yields fell sharply as investors expected the ECB to accelerate its rate cuts. However, French bonds underperformed given the country’s fiscal situation and uncertainty over whether the current government will remain in office.

The European credit market ended with a positive performance at the end of November, largely due to rate movements. Indeed, spreads increased by a few basis points, without a strong underlying trend appearing. In the US, spreads fell sharply, driven by expectations of pro-business policies.

Despite the recent volatility in rates, we recommend keeping duration close to that of the market.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.