Good things come to those who wait

Good things come to those who wait

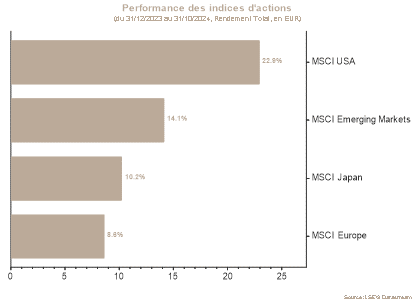

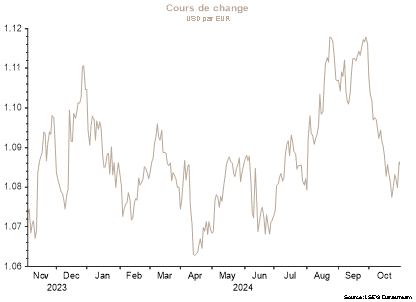

A timid October has just ended on the financial markets, with a slightly positive performance of global equities at +0,50%*. It should be noted from the outset: the currency clearly has a different impact in Europe than on the other side of the Atlantic. In dollars, equities lost nearly 2% over the same period. As a result, this currency effect has proved favourable to European investors (the dollar appreciated by 2,30% against the euro) and helped to mask the fall in equity prices in dollars.

In geographical terms, the US markets nevertheless held up well (-0,75% in USD, or +1,85% in EUR), while their European and emerging market counterparts lost -3,26% and -4,45% respectively.

On the fixed income front, it was a rather difficult month, with rates moving up globally. Benchmark 10-year rates in the US and Germany rose by around 60 and 40 basis points respectively. Similar movements were observed on 2-year rates, despite central banks’ efforts to reduce their key rates. Several factors can explain these sharp movements: US economic resilience, not to mention the large budget deficit, which is likely to remain high based on the economic programmes of the candidates for President.

A degree of unease and volatility in the markets is customary before US elections. This is all the more understandable given the high level of polarisation and with polls projecting a very close race between the two candidates. This increased fears that the results would not be accepted by the losing party.

With a fairly clear victory for Donald Trump, the worst scenarios have been avoided. The smooth running of the elections, as well as the pro-business and pro-market policies promised by the incoming President, significantly boosted sentiment. The famous “Trump Trade,” which consists of favouring US equities on the basis of higher nominal growth, gained popularity as soon as the first results were announced. With US sovereign yields and the dollar rising sharply, gold, which had been on the rise for several months, lost nearly 3% in the post-election period.

Returning to economic fundamentals, it should be noted that the most recent growth figures have been reassuring. According to initial estimates, the US economy grew at an annualised rate of 2,8% in the third quarter, which is still well above the growth potential estimated by the US Federal Reserve (Fed) at nearly 2%.

In Europe, expectations are naturally tilted to the downside, but the published figure (0,40% on a quarterly basis, i.e. 1,60% annualised) seems entirely adequate. German growth surprised on the upside: while expectations were at -0,1%, the first estimate reached 0,2%. Despite this solid figure, the German economy continues to struggle. The plant closures announced by Volkswagen, a first in the company’s history, point to a broken business model.

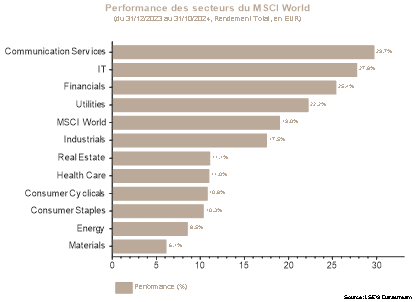

As uncertainties around the election dissipate rapidly, it is preferable to overweight equities in order to reap the benefits of a potential relief rally. This overweight is achieved through US equities, which are the most likely to benefit from Trump’s economic and fiscal policies. This is true insofar as economic conditions remain favourable and the financial health of companies is good. The sectors that continue to be favoured are Technology and Communications Services, the big winners in the artificial intelligence theme, as well as US banks, which benefit from potential deregulation and future tax cuts, followed by Healthcare, benefiting from stable earnings growth.

In terms of fixed income, the budget deficit and strong growth make duration unattractive on US bonds. The deficit is also a problem in Europe, but growth remains weak, which boosts the argument for slightly longer duration than that of US bonds.

*Performances are calculated in euros.

Stock markets

In October, the concentration of risk around the US elections led to a significant dispersal in the evolution of equity indices. On the microeconomic front, the positive impact of corporate earnings, which were better than expected on both sides of the Atlantic, contrasted with rising concerns linked to a historically uncertain electoral environment in the US. In anticipation of a rebalancing of specific risks within portfolios, the US banking sector was revalued upwards, as were US small and mid caps, which continue to benefit from the rotation away from large caps. In addition, the euphoria triggered by China’s stimulus packages faded sharply, giving way to greater scepticism about the real impact of fiscal measures in the short term. With an approach that remains constructive, after taking into account the structural challenges currently facing the Chinese government, we made a downward readjustment to the positioning on the region at the end of the period. A more limited-than-expected military escalation in the Middle East had a moderate impact on oil prices, the decline of which was accentuated by the imprecise message of OPEC+ on production capacity. Consequently, the tactical positioning on Energy was downgraded.

Sovereign rates and credit market

In October, sovereign rates rose significantly in the United States and in Europe. The 10-year yield rose by 50 basis points (bp) and the 2-year by 53 bp. In Germany, the 10-year rose 27 bp and the 2-year rose 21 bp. Moreover, since the beginning of September, yield curves have returned to normal, with the 10-year rate being higher than the 2-year rate.

The US published positive economic data reflecting the resilience of its economy, and its latest inflation figures showed a less rapid deceleration than expected. Given these data, investors have been led to reduce the number of key rate cuts expected. Indeed, while this may have been the case a few months ago, the market is no longer considering the likelihood of a rapid and strong Fed intervention. More generally, in the run-up to the US elections, volatility rose on the bond market while the increased probability of Donald Trump’s return to the White House, accompanied by potential fiscal stimulus, also affected movements in US rates. As soon as the results of the election were announced, the upward movement in yields was confirmed.

In Europe, rates also rose, albeit to a lesser extent than in the US. The European Central Bank continued to cut rates in October, lowering its key rate twice to bring it to 3,25%. Prior to the US election results, the latest economic data led markets to tend towards less aggressive expectations in terms of rate cuts. However, the incoming President’s economic policies run the risk of undermining the European economy and exerting downward pressure on rates.

The credit market ended with a negative performance at the end of October, due to the movement in rates. Indeed, spreads tightened throughout the month and buoyed overall performance, still supported by technical factors (weak primary supply and some appetite for credit risk).

Despite the recent volatility in rates, we recommend keeping duration close to that of the market.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.